Many of our clients have held investments and pensions with us for over a decade and have experienced how a well managed fund can produce very attractive returns over the years.

However we understand that entering into these types of contract can be nerve racking for the best of us!

We endeavour to keep things simple and find a fund suitable for those who want to take very little risk right the way through to individuals who have a more “adventurous appetite”

Either way we believe that risk can be spread through diversification (not putting your eggs in one basket)

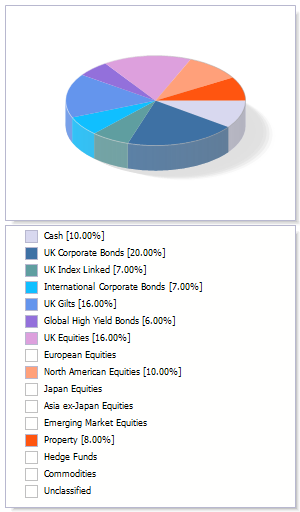

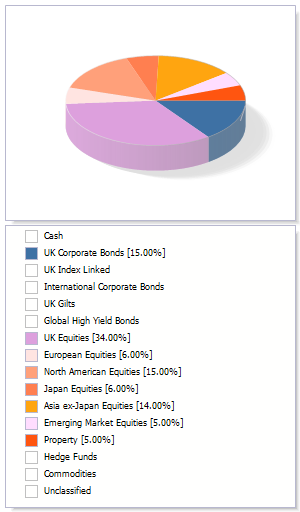

If you think of risk on a scale of 1 to 10 the graphs below illustrate the “make up” of a typical risk 3 fund and in contrast a typical risk 6 fund.